Insights

Periodic insights from our Investment and Private Client Teams on a broad range of investment and advice-related topics

Alternative Asset Investment Strategies – An Important Source of Diversification in an Evolving Market

Published by the Private Client Team at KJ Harrison Investors

Introduction

After a 30-year bull market in bonds and a strong, multi-year recovery in equities following the global Great Recession of 2008-09, investors wonder what lies ahead for financial markets. Since 2009, U.S. financial markets have provided noteworthy returns accompanied by declining market risk. Looking forward, we expect a more normalized environment of moderated annualized returns and higher volatility. The current low interest rate environment and the search for non-correlated asset class solutions are increasingly prompting investors to rethink their allocation decisions with regard to alternative investment strategies (although it should be noted that while non-correlated asset classes can provide diversification benefits, correlations tend to increase during periods of financial crisis).

Although the term “alternative investments” includes significantly less liquid asset classes such as real estate, private equity, venture capital, commodities and even asset classes such as collectibles and fine art, more investors are considering liquid alternative investments as potential sources of investment returns (as measured by asset flows into Morningstar’s alternative mutual fund categories, as of September 2015).

The path to building an alternative asset allocation can hinge on a variety of factors, from expertise in the asset class to risk tolerance and due diligence capabilities. Whichever path an investor chooses, the key, in our view, is to seek similar results: a well-diversified allocation with the potential to provide a driver of returns in addition to traditional stocks and bonds.

Growing Relevance of Alternative Sources of Return

What is in the cards for capital markets? Three important themes will likely remain on investors’ radar in the months ahead:

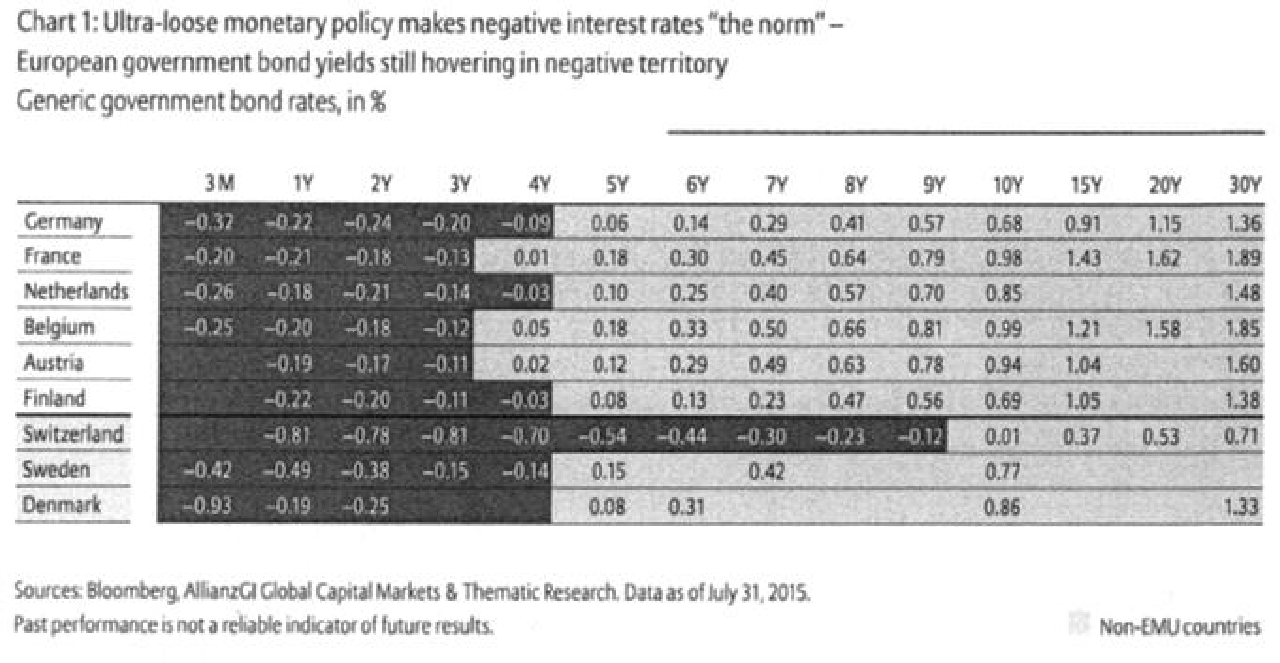

- Financial repression is not only set to continue, it has even reached a new level. In the past, bonds traditionally provided the best way to mitigate down markets providing current coupon and capital appreciation in challenging equity market conditions. Regardless of the recent correction in bond markets, investors are still facing negative nominal yields for government bonds with solid credit rating (see Chart 1).

The path to building an alternative asset allocation can hinge on a variety of factors, from expertise in the asset class to risk tolerance and due diligence capabilities.

It speaks for itself when roughly 50% of outstanding German Bunds are now in negative territory. Neither real nor nominal bond yields in negative territory are able to play their traditional role for income generation. At the same time, downside risks are on the horizon as markets must start pricing in higher global central bank rates in the coming years. This is why alternative strategies, especially on the low-risk, low-return end of the spectrum, are becoming increasingly popular among investors seeking an alternative to bonds in low-yielding times.

2. Ongoing expansionary monetary policy globally, and a world economy at around potential, should support risky assets. Nevertheless, valuations of various asset classes are stretched – after more than five years of bull market, stocks in some geographies might deliver fairly little upside potential. Therefore, many investors are looking for alternative non-correlated strategies with low net exposure that complement their equity and bond allocations.

3. Last but not least, investors should be prepared for increasing volatility. High valuations of various asset classes, a first rate hike by the U.S. Federal Reserve in December 2015, as well as intensified geo-political risks could temporarily provide some headwinds for risk assets. Managing volatility and buying protection against draw-downs will therefore gain importance.

Against this macroeconomic and market outlook, investors must find new ways to complement their traditional asset allocations in order to achieve their investment objectives. With clients looking for bond substitutes (i.e., income generation with managed volatility), new betas and new sources of alpha, uncorrelated returns, enhanced portfolio diversification, lower volatility and tail-risk protection, the relevance of alternative sources of return is growing. The alternative universe features diverse investment styles and strategies, each with its own expected risk/return profile, which can be used as tools to customize portfolios.

Alternative asset investing has become central to prudent asset allocation and is now in wide use among institutional and high net worth investors. According to the Canada Pension Plan Investment Board’s 2014 Annual Report, the CPPIB has increased allocations to alternatives absolute return strategies from 4% to 40% of the fund from 2005 through 2014. Based on a recent McKinsey & Company report, global assets under management in alternative investment strategies has grown from $3.2 trillion in 2005 to over $7.2 trillion in 2013 (McKinsey & Company: “The Trillion-Dollar Convergence: Capturing the Next Wave of Growth in Alternative Investments”).

What are Alternative Investments?

“Alternative investments” is not an asset class in itself. Rather, the alternative investment universe has several characteristics, including:

- Traded asset classes that fall outside the traditional definitions of publicly traded stocks and bonds, such as commodities and currencies;

- Niche real assets such as timberland, fine wines, antique furniture, antique automobiles, and fine art, as well as intangible assets such as royalty streams can be considered alternative to traditional investments;

- Trading strategies that are not available to traditional long-only investment managers, such as shorting, using derivatives as hedging strategies and the use of leverage to amplify returns;

- Investment strategies that rely on privately negotiated deals (and are significantly less liquid) such as private equity, private and mezzanine debt, as well as infrastructure asset investments.

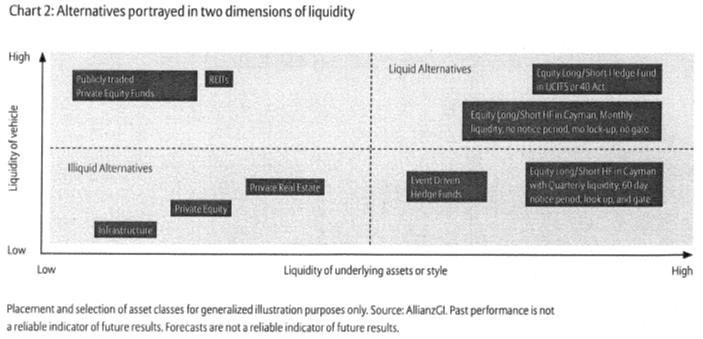

Alternative investments can be categorized in terms of the liquidity of the underlying assets or investment style on the one hand and according to the degree of liquidity of the vehicle on the other (see Chart 2). Following the financial crisis, investors have increasingly requested a stronger alignment between the underlying assets’ liquidity and the investment vehicle’s liquidity.

Trends in Alternative Investments

Three broad trends have reshaped the alternative investments industry in recent years:

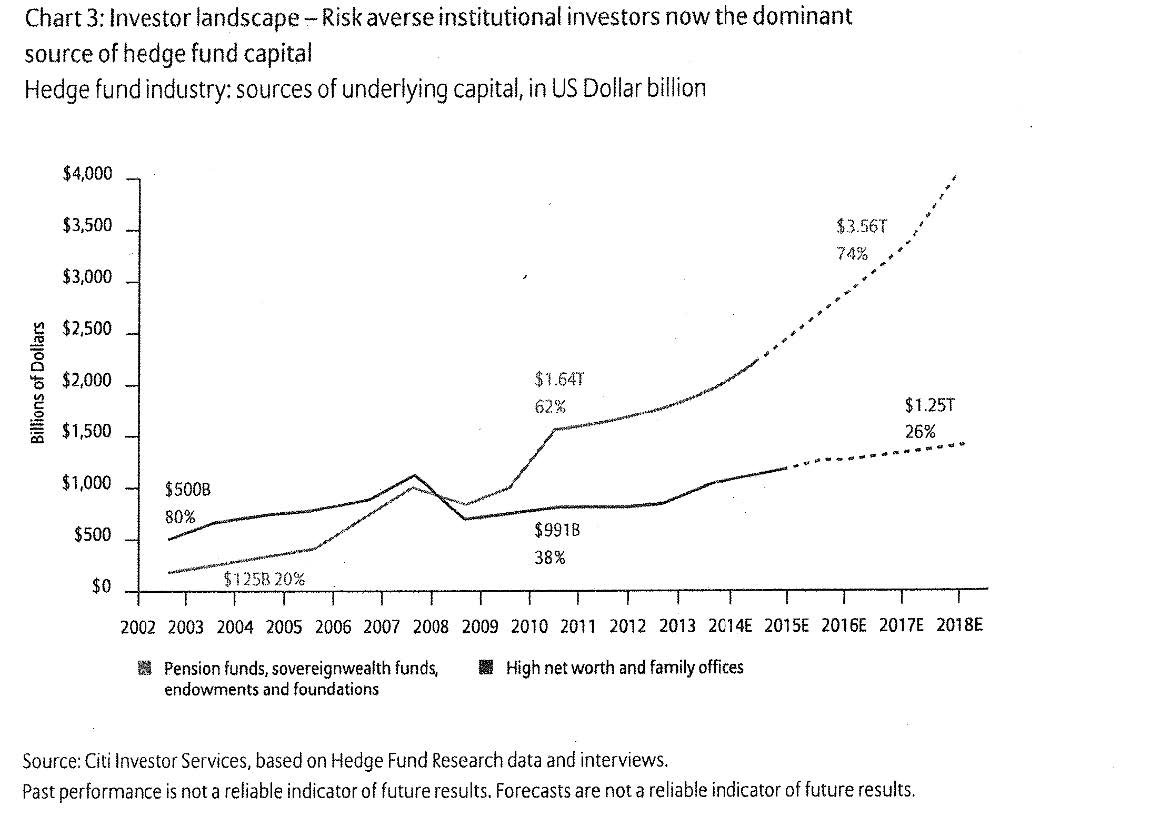

- Institutionalization: A shift in the dominant investor base from risk-tolerant investors to more risk-averse institutional investors (see Chart 3). This shift in the sources of capital has corresponded to a rise in low risk/low return alternatives within the industry. Simultaneously, more institutions are getting their alternatives exposure directly from asset managers rather than from fund-of-fund providers. For example, according to the Canada Pension Plan Investment Board’s 2014 Annual Report, the Canada Pension Plan Board, one of the largest institutional investors in Canada and globally, has increased allocations to alternative absolute return strategies from 4% to 40% of the fund from 2005 through 2014.

- Retailization: The rapid growth of fully regulated alternative mutual funds in the United States and the parallel growth of alternative investment funds in Europe and Asia. This has enabled small investors to gain access to alternative strategies that were previously only available to large institutional investors.

- Regulation: Globally, offshore alternative investment funds such as those located in the Cayman Islands and Bermuda have lost market share to fully regulated alternative investment mutual funds and investment management firms in North America, Europe and Asia.

The Rise of Alternatives

Alternative investments have grown rapidly in recent years, twice as fast as non-alternatives since 2005. According to a recent McKinsey & Company report, from 2005 to 2013, alternative assets under management grew from US $3.2 trillion to US $7.2 trillion (McKinsey & Company (2014): “The Trillion-Dollar Convergence: Capturing the Next Wave of Growth in Alternative Investments, p.7). Growth has been broad-based across all alternative asset classes (defined here as hedge funds, private equity and real estate assets) (see Chart 4). Looking forward, PricewaterhouseCoopers predicts that this mainstreaming of alternative investments will continue and that assets managed could reach US $13 trillion by 2020 (PwC (2014) “Asset Management 2020: A Brave New World”, p. 8).

A Variety of Investment Choices

Historically, alternative investment strategies were offered solely in private, less liquid vehicles, many of which were created and managed offshore. More recently, alternative asset mutual funds and investment portfolios offered by private investment management firms have made these strategies more accessible to investors who prefer or require regulated investment vehicles. Within these, a great variety of different investment strategies can exist, although investors should make sure that the underlying assets or style of the strategy matches well with the liquidity of the fund vehicle.

According to Hedge Fund Research, there are at least four broad “alternative asset” investment categories:

- Event-driven strategies are typically based on a corporate restructuring or acquisition that creates profit opportunities for long and short positions in common equity, preferred equity or debt of a specific corporation.

- Relative value strategies involve buying a security and selling short a related security with the goal of profiting from a perceived pricing discrepancy. By way of example, investors are able to participate in the returns of volatility of an asset class with a strategy based on harvesting the variance risk premium.

- Macro strategies are “top down” investment strategies based on global economic trends and events which may involve long or short positions in equities, fixed income, currencies, or commodities.

- Equity hedge fund strategies are “bottom up”driven investment approaches that seek to profit from long or short positions in publicly-traded equities and/or derivatives with equities as their underlying assets.

Alternative Assets Offer Diversification

Alternative strategies tend to produce different performance patterns than long-only stocks and bonds under the same market conditions. Many alternative strategies have been designed to maintain a low beta, so they move less in line with the market, providing diversification, and the potential for protection in down markets – in the original sense of the word “hedging”. Adding liquid alternatives to a traditional portfolio allocation can benefit a broad range of investors in terms of improved risk-adjusted returns, enhanced diversification, and potentially lower market sensitivity.

Comparing the short-term performance of aggregated hedge fund indices with equity indices such as the S&P 500 can be misleading, especially during a stock bull market, as many alternative strategies are designed to protect investments during draw-downs rather than to necessarily outperform during market rallies. That is, their usefulness to investors often increases later in the cycle. Greater clarity can therefore be gained by looking at long-term figures.

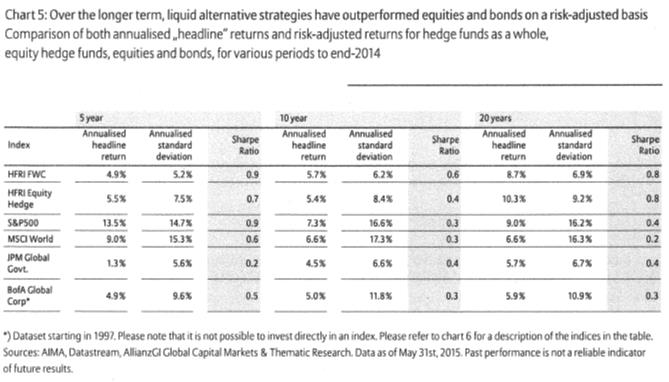

On a risk-adjusted basis, which measures the value of the returns in terms of the degree of risk taken (ie, “Sharpe Ratio”), hedge funds have outperformed U.S. equities, global equities, and global corporate and government bonds over the longer-term (see Chart 5). As this chart illustrates, even over the last five years, including the post-financial crisis equity bull market, the S&P 500 and MSCI World have not performed better than the HFRI FWC on a risk-adjusted basis.

Besides attractive risk-adjusted returns, the pattern of returns has been beneficial. On average, alternatives haven’t performed as well as stocks in bull markets, that is, lagging the return of global equities in up markets; however, they also haven’t lost as much in bear markets. During the extreme market stress of the financial crisis of 2008-09, the maximum drawdown (largest peak-to-trough loss over a period) of the HFRI FWC amounted to 21.4% between November 2007 and March 2009, while, by way of example, investors in the S&P 500 experienced a 57% drawdown.

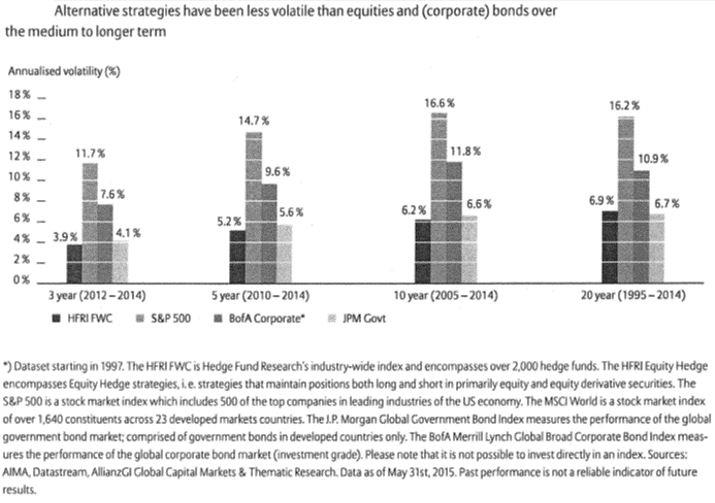

Similarly, when comparing annualized volatility figures it is clear that alternatives have not only been less volatile than equities, which might be expected, but also less volatile than corporate bonds (see Chart 6). Roughly speaking, alternative strategies have provided less than half the volatility of stocks over the last 20 years.

Concluding Remarks

After a strong, multi-year recovery for equities, and with more volatility anticipated, the search for alternative sources of return is growing. Adding liquid, alternative investment strategies to a traditional portfolio allocation might benefit a broad range of investors, not only in terms of improved risk-adjusted returns, but also by providing enhanced diversification, and potentially lower market sensitivity.

These strategies are increasingly available with liquidity and transparency. The alternative investment universe features diverse asset classes and investment styles, each with its own expected risk/return profile. These can be used as tools to customize portfolios.

Importantly, as with any investment, no one strategy should be considered in isolation. Instead, each sector and security should be evaluated for its projected risk/return contributions to the larger portfolio. Also vital to the ultimate allocation decision is each investor’s goals and tolerance for risk, liquidity and taxes.

Now is a time to avoid complacency with what has worked well in the recent past and look beyond traditional asset classes. Of course, as with any investment opportunity, allocating too much alternative portfolio capital is ill advised. Working closely with experienced, trusted advisors is the optimal path towards solving the upcoming challenges of a more volatile and potentially lower return market environment.