Insights

Periodic insights from our Investment and Private Client Teams on a broad range of investment and advice-related topics

Published by the Private Client Team at KJ Harrison Investors

What was once only imaginable in our wildest dreams is now our reality

ʺAs we look ahead into the next century, leaders will be those who empower others.ʺ – Bill Gates

Tech Trends are Shaping Everything

Not so long ago, much of the excitement that came along with travelling was the idea of uncertainty and discovery. Today, Google Maps provides the ability to drop a virtual person to your exact location of interest for a full 3D immersive experience – you are no longer required to leave your home to discover a new destination. Technology has, and will continue to transform our lives and the global economy as we know it. Contrary to popular belief, the tech trend is just getting started, as a multitude of emerging technologies such as robotics, artificial intelligence, biotechnology and blockchain continue to mature.

Disruptive technologies are proving to be superior and cheaper than their predecessors, with the ability to threaten stable businesses faster than ever. Virtually every industry today, from retail to financial services, is undergoing major changes. Those that choose to embrace new technologies will thrive, while others risk being left behind. In other words, big winners and losers will emerge within the capital markets. Our goal, at KJ Harrison, is to help navigate the investment landscape in order to capitalize on the profitable opportunities and avoid the unprofitable ones – while paying close attention to each client’s investment goals, risk tolerance and time horizon.

Digital Platforms will Define our Future

The key is to own “the” next digital platform and not focus on the next innovative product company – we want to own the de facto monopoly, rather than a company with exposure to the product cycle. A digital platform is a software and networking infrastructure that is able to build multiple revenue streams, and extract the majority of profits from the industries it services. Recent examples include Amazon, Google, Facebook and the Chinese tech giant, Tencent. These platform companies will have the opportunity to capture a disproportionate share of industry profits based on the success of the other companies that directly or indirectly use their services.

Think of a company like Apple, which offers the newest technology products including iPhones, Macs and iPods. Apple, however, will also generate substantial revenue from its vast services segments such as iTunes, iCloud, Apple Music, Apple Pay and the App Store.

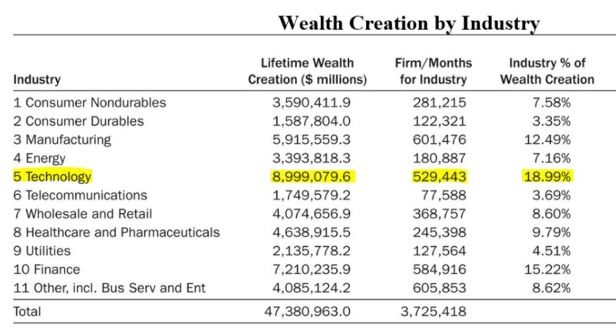

The chart below shows the industries that created the most wealth between 1926 and 2019. As you can see, the Technology sector created almost $2 trillion more wealth than the next most productive sector ($9 trillion for Technology against $7.2 trillion for Finance).

The graph below (Figure A) offers a good depiction of the disproportionate amount of wealth creation coming from technology companies. The ability to identify the big tech winners, such as Amazon, Facebook, Google and Microsoft, has been the primary wealth creation driver in public equity markets over the last 90+ years.

Figure A: The Industries that created the most wealth from 1926 to 2019.

Source: https://alphaarchitect.com/2021/10/a-history-of-wealth-creation-in-the-u-s-equity-markets/

Throughout our lives, we have seen incredible technological progress but it is the speed of the current breakthroughs that has no historic precedent. In this issue of Wealth, Health & Kids™, we focus on some of the many disruptive technologies that exist today, including artificial intelligence and autonomous driving, blockchain and gene therapy. In doing so, we will highlight some of the emerging technologies that can shape our future, and that of our children and grandchildren.

Artificial Intelligence is No Longer a Fascination of Science Fiction

It may sound outrageous, but with the introduction of virtual assistants such as Apple’s Siri and Amazon’s Alexa, we have begun communicating with our devices on a regular basis. Technology companies are now looking to take things one step further by building not only autonomous, but also sentient robotic machines. How would you react if you were told robots could become citizens and coexist with humans? Well, in October 2017, Saudi Arabia granted citizenship to Sophia, a social robot that is capable of processing emotional and conversational data through the use of AI software developed by Hanson Robotics. Stephen Hawking, Bill Gates and Elon Musk have all voiced their concerns regarding the runaway speed of growth within artificial super intelligence, known as “technological singularity”. AI is becoming so competent that there are rising fears there will be no functions left for humans to serve.

Today, we are entering a new age of artificial intelligence that will inevitably transform many aspects of our social and working lives. A 2018 report by Price-Waterhouse-Cooper (PWC) found that 38% of U.S. jobs could be at high risk of automation by the early 2030s[i]. As an example, Alphabet’s Waymo, General Motors’ Cruise, and Tesla Motors (among others) have already started testing fully autonomous cars, threatening the livelihoods of millions of truck and taxi drivers.

The automobile industry is experiencing a technological transformation; electrical vehicles have become a viable means of transport, and various companies have started testing self-driving vehicles. Along with a diverse range of radar technology, AI is used in self-driving vehicles in order to collect, process and perform specific actions – in other words, to help the vehicle navigate without any input from humans.

Enterprises are Jumping in on AI

At the forefront of AI and deep learning is NVIDIA Corp. (NVDA). Its core technology, the graphics-processing unit (GPU), is used in the machine-learning that powers Facebook’s AI and machine learning tasks. This allows Facebook to detect faces in pictures, and personalize your news feed.[ii]

SoftBank’s Vision Fund is another example of the profound impact that tech is having on the overall market. In May of 2017, the fund raised a staggering $100 billion. Subsequently, SoftBank made investments in the fields of artificial intelligence and robotics, as well as more household tech names such as Uber, DoorDash and Slack. SoftBank CEO Masayoshi Son, believes smart machines have the potential to create an “even bigger gold rush” than the first internet companies of the early 2000’s.

The Fastest Growing Asset Class Ever Seen

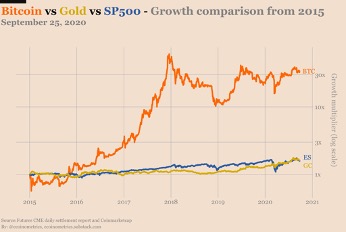

Bitcoin has garnered much attention in recent history – and for good reason. We have seen wild swings in the value of the digital asset. It reached levels of approximately $20,000 USD per Bitcoin in December of 2017 (the all-time high was either just over, or just under $20,000 USD, depending on which exchange you observed). It was a major topic of discussion at many Christmas dinner tables that year. Its price has since retreated, but that hasn’t prevented other players from emerging. Other crypto assets such as Ethereum, Solana, Cardano and Terra, along with probably a dozen other crypto assets, have gained some traction, as measured by a market cap above $20 billion, alongside Bitcoin.

Source: https://twitter.com/100trillionUSD/status/1322943547109216258/photo/2

What is Bitcoin?

Created in 2009, Bitcoin is one of the first-ever digital assets to use peer-to-peer technology. A digital currency is an electronic payment method, or medium of exchange, that can be transferred between computers or smartphones. Bitcoin promises lower fees, instant transactions with peers (with the assistance of third-party applications), and unlike traditional government-issued fiat currencies such as the U.S. Dollar, it is not controlled by a centralized authority[iii]. With Bitcoin, you can now send and receive money anywhere in the world within seconds, without the need for an intermediary such as a bank.

We, at KJ Harrison, have been asked numerous times about our view on Bitcoin as an investment, so let us address this question first. There are many inherent risks when it comes to Bitcoin: government intervention, unregulated Initial Coin Offerings (think IPO for a digital token) as well as scalability issues. As such, we have seen tremendous volatility in crypto prices. Huge run-ups are often followed by steep declines, and given this volatility, we may very well see a huge shakeup in cryptocurrency down the road.

The question is when?

Demand for digital assets has, at times, been resilient; as with any other asset class, the price of Bitcoin is a function of simple supply & demand. If our society ultimately believes in the transition towards Bitcoin and digital assets, then it is only a matter of time until they will be accepted as a legal tender (Bitcoin was recently adopted as such in El Salvador), and the more demand will increase. However, if it cannot overcome its security and scalability issues, then it will end up on the scrap heap of failed technologies. While the Bitcoin network itself has never been hacked, a number of the third-party application providers have seen substantial attacks resulting in hundreds of millions of dollars worth of digital assets stolen. Additionally, the transaction confirmation process of the blockchain itself cannot handle the volume of transactions that would be required of it should it become legal tender in a first-world, developed economy.

It is important to note that crypto prices are not justifiable based on their underlying premise, business or uses – they are now purely in speculative territory. In short, buying cryptocurrency is by no means an investment. There are no revenue streams, and is backed only by the belief in future adoption. Furthermore, Bitcoin is only one of thousands of cryptocurrencies already available, making it hard to predict which one will survive.

“Serious investing consists of buying things because the price is attractive relative to intrinsic value. Speculation, on the other hand, occurs when people buy something without any consideration of its underlying value or appropriateness of its price, solely because they think others will pay more for it in the future”. – Howard Marks, Oaktree Capital Management, L.P.

Blockchain Technology

Despite the lack of clarity when it comes to Bitcoin, the technology behind it is here to stay and it has the ability to change our lives and businesses.

So what is it?

Don and Alex Tapscott said it best: “Blockchain is the ingeniously simple technology that powers Bitcoin. But it is much more than that, too. It is a public ledger to which everyone has access, but which no single person controls. It allows for companies and individuals to collaborate with an unprecedented degree of trust and transparency. It is cryptographically secure, but fundamentally open. And soon it will be everywhere.”

Blockchain, also known as distributed ledger technology, provides a decentralized database of transactions visible to everyone on the network. The network is essentially a chain of computers that must collectively approve an exchange before it can be processed. Within the network, not only can information be exchanged but also money, identification, music, art or intellectual properties.

For example, there are few things that are more valuable than documents showing your birth date, SIN or marital status – information that opens your rights to all sorts of privileges. With Blockchain, this privileged information can be secured and encrypted within the network empowering citizens to access and give access to this crucial information exclusively on an as-needed basis.

This new technology is so important that major financial institutions have decided to collaborate on the development of Blockchain. This can be seen with the Enterprise Ethereum Alliance (EEA), a not-for-profit organization that includes members such as Microsoft, J.P. Morgan, Intel, Ernst & Young, ING, Citigroup, and FedEx[iv].

The second largest Blockchain is Ethereum. Often misinterpreted as one and the same, Bitcoin and Ethereum are actually fundamentally different technologies. An important difference between them is Ethereum has the ability to run “smart contracts”. A smart contract is self-enforcing digital contract that will only transfer funds or information when the stipulated conditions are met. Those conditions are agreed upon and enforced by computers globally. Most importantly, smart contracts have the potential to virtually eliminate the middle-man from any transaction.

While Bitcoin focuses on payments and was invented as an alternative to traditional fiat currencies, Ethereum has developed a virtual economy. This economy uses the Ether – an Ethereum-based digital currency – as a token of trade. The ability to write code and develop applications on the Ethereum Blockchain allows for many different use cases such as crowdsourcing, voting, gambling and even new forms of currency. Often cited as the more advanced Blockchain platform, Ethereum’s real life uses are limitless.

There has also been a rise in popularity of “permissioned” blockchains. These are different from Bitcoin and Ethereum in that they have a centralized authority. Facebook made significant headlines in June of 2019 when they announced Libra, a blockchain-based cryptocurrency that initially had a number of high-powered backers, such as Visa, Mastercard, eBay, Stripe and PayPal. Many have since pulled their support[v]. The project was scrapped due to some significant regulatory hurdles that couldn’t be cleared in order for Libra to become commercially viable.

Gene Therapy: A New Exciting Area in Biotechnology

Gene therapy technology is a medical breakthrough, offering a new spectrum of medical potential. Lab results have shown that it is now possible to modify cells and implant them back into the human body. Effectively removing unhealthy genes and replacing them with healthy ones, providing the potential to cure rare and deadly diseases from cancer to HIV. The potential one-time gene therapy treatments can eliminate the need for ongoing treatments. Imagine the possibilities.

CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats), a form of gene therapy, and a very precise way of editing DNA, has been called the start of a new era of genetics. CRISPR gene-editing technology edits out serious disease-causing genetic mutations. New DNA is inserted directly into a patient’s genes using a cut-and-paste method[vi]. The new genes are designed to integrate with the patients’ existing DNA. CRISPR technology may even be used on embryos, to cure people of a wide range of genetic disorders before birth. This technology will change the way we think about genetic engineering.

There has been a growing interest in gene therapy from big drug companies, such as Pfizer and Gilead, who are keen to take advantage of the new commercial opportunity. Most recently, Gilead Pharmaceuticals obtained FDA approval for a new CAR T-cell therapy (chemical antigen receptor) called Yescarta. Yescarta is manufactured by Kite Pharma, an Israeli-founded company acquired by Gilead in August 2017[vii]. Yescarta is a highly tailored gene-altering treatment for patients suffering from lymphoma, and will revolutionize the way cancer is fought. Through immunotherapy, the patients’ infection fighting T-cells are extracted and genetically modified with a new gene to pinpoint and attack malignant cancer cells.

Although there are inevitably ethical issues and safety concerns, these new technologies present an incredible opportunity to alleviate human suffering and eliminate life-threatening disorders.

Concluding Remarks

The technologies discussed in this segment of Wealth, Health & Kids™ are in their very early stages of expansion. However, they have already displayed their potential to have a strong positive impact on our social and working lives. At the same time, they have demonstrated that they are capable of disrupting certain industries and upending established businesses. By paying strict adherence to our KJH investment philosophy, and conducting deep fundamental research, financial analysis and physical due diligence in making all investment decisions, we strive to help our clients navigate this rapidly transforming investment landscape.

KJ Harrison’s vision is to be the most relevant private client firm in Canada for high net worth families, centred on outstanding investing and strategic advice, where clients are treated like partners. Throughout various market cycles we have, and will continue to encounter powerful disruptive technologies. However, we are consistently able to adapt. As a firm, our core values, long-term vision and promise to deliver exceptional client service have proven the ability to withstand any technological disruptions.

Until next time,

THE KJH TEAM

Information presented in this article was obtained from sources believed to be reliable but accuracy, completeness and opinions based on this information is not guaranteed. Under no circumstances is the information presented in this article intended to constitute legal, financial, accounting or tax advice. The reader should consult with the appropriate professional experts and seek legal, tax, financial or accounting advice specific to his/her circumstances before acting on any information presented in this article.

[i] www.pwc.co.uk/economic-services/ukeo/pwcukeo-section-4-automation-march-2017-v2.pdf

[ii] https://nvidianews.nvidia.com/news/nvidia-gpus-power-facebook-s-new-deep-learning-machine

[iii] www.investopedia.com/terms/b/bitcoin.asp

[iv] www.entethalliance.org/

[v] www.nytimes.com/2019/10/11/technology/facebook-libra-partners.html

[vi] www.barrons.com/articles/gene-therapy-is-nearing-a-major-breakthrough-1506140340

[vii] www.wsj.com/articles/gilead-cell-therapy-drug-yescarta-gets-fda-approval-1508364454